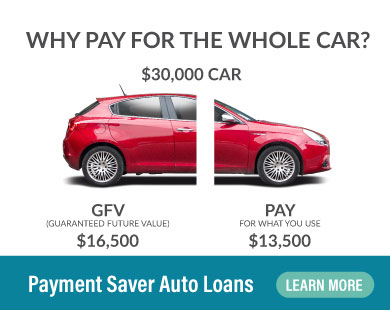

Paysaver Auto Loan Program

Then at the end of the loan you will owe the remaining balance of the loan itself.

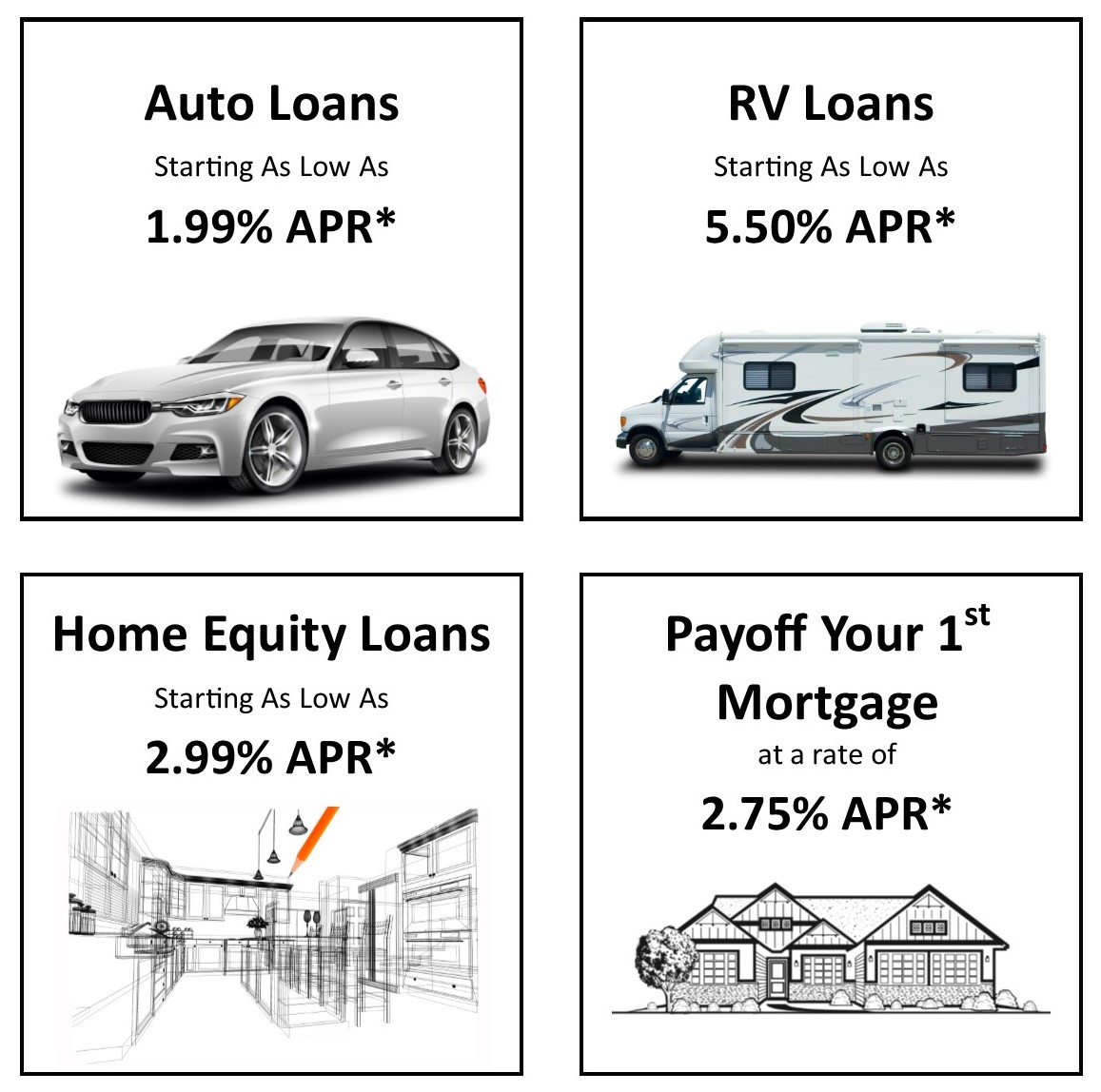

Paysaver auto loan program. Like a lease the payment saver auto loan offers payments that are considerably lower than conventional financing. Most people turn to auto loans during vehicle purchase. They work as any generic secured loan from a financial institution does with a typical term of 36 or 60 months. Pay your loan using your keesler federal account using keesler federal everywhere you can set up recurring loan transfers or make a one time transfer from your savings checking or himma account for free.

New and used vehicles up to five years old qualify. If all discounts were applied an estimated monthly payment for a 25000 new vehicle up to 84 months at a floor rate of 199 apr is 31908. But unlike a lease with the payment saver auto loan program you own the vehicle and have all of the flexibility and benefits of vehicle ownership. Get offers to buy finance and insure your next vehicle all in one place with the help of a personal shopper who guides you through the entire process.

To apply for a loan over the phone or ask questions call 855 548 4787. Each month repayment of principal and interest must be made from borrowers to auto loan lenders. Payment saver info sheet. Other features of the payment saver auto loan include.

Whether you are buying a new or used vehicle or refinancing your existing auto loan this program can save you money. Designed to help you in case of mechanical failure of major mechanical components of your vehicle. Carsaver is a fast fun and easy way to find the car you want for the price you want to pay. You can add this protection to your loan payments at any time during the term of your loan or you can purchase the protection outright if you financed your vehicle elsewhere.

Usecus payment saver auto loan program offers just that. Auto loan refinance program rates are based on the original financing contract presented to the credit union as part of the application process. A payment saver auto loan can help boost your buying power to drive a newer car with lower maintenance costs a safer car with 4 wheel drive or a larger car to accommodate your family. 2 for required disclosures.

Motor vehicle acquisition plan map loan this program combines the best features of a lease with the advantages of vehicle ownership.